Travel Hacks In Retirement

You certainly do not have to be retired, or even be thinking about retirement, to take advantage of good travel and life hacks. We’ve done a lot of “hacks” research over the years; some of which work for us, some not so much. As we transitioned into retirement we knew we’d need to find a way to make travel (and life) affordable. In this post we’re going to talk about some of our well-used travel and life hacks in retirement, and how we make it all work for us.

A Million Dollars

Firstly, we don’t believe you have to have a million dollars in the bank to retire. We certainly did not. There is so much chatter out there in cyber space about how much money one “must have” in order to enjoy a comfortable retirement. A quick Google search shows only about 10% of Americans have a million dollars upon retirement, while the average 401K account of a person aged 65+ has approximately $250K upon retirement.

Of course, not everyone has the same resources available, so it all boils down to what is actually affordable and making choices about how you want to live in retirement. For us, with a few years of purposeful planning we positioned ourselves to achieve our goals.

- “Our goals can only be reached through a vehicle of a plan, in which we must fervently believe, and upon which we must vigorously act. There is no other route to success.” – Pablo Picasso.

How We Make it All Work

Our sources of income include social security, a 401K retirement account, and a public employee pension. We retired at 63 and 58.

- Our budget for travel is 10K +/- per year.

- We retired to the State of Maryland to be near our kiddos. Maryland is not an inexpensive state in which to retire, but we bought a small house that is financially manageable and just 4 miles from said kiddos.

- We both applied for social security on the early side of retirement. There are many opinions (some quite strong) as to when one should apply for social security. We applied at 64 and 62. We calculated it would take 8 years for me to catch up to the amount I would have gotten if I had waited and applied at 65. Applying at 62 seemed a safe bet and it cushioned our transition to retirement sooner than later.

One Road at a Time

Our website has been in business for 11+ years. And, while it is not a source of income in the traditional sense, it is a business from which we benefit. We sell advertising on our site and from time to time we partner with organizations for in-kind collaborations.

One Size Does Not Fit All

One size does not fit all. It’s a great metaphor for so many aspects of life. Retirement, and specifically looking at how to travel in retirement, is not a one size fits all book. We asked ourselves if we really needed a second car, a big house, fancy dinners, or new clothes every year. The answer, for us, was a resounding no. There is certainly nothing wrong with any of those choices, but again, it’s all about purposeful planning and what you want in your life; what works for you.

Daily Life Hacks

It’s just the two of us so a small house is all we need, or want, and it’s easy to maintain. We own just one car. During Covid we stopped going to full-service restaurants and movie theaters. It turns out we didn’t miss it. Post covid we prefer to stream movies at home. We subscribe to two streaming services, but we cut the cable cord which saves us nearly $1,000/year. We’d much rather use that $1,000 for travel expenses.

It’s amazing how much anyone can save with a few relatively painless cuts.

Travel Hacks

Again, one size does not fit all and maybe our travel hacks will work for you, or maybe they won’t. We’ve spent years fine tuning our choices to make it all work for us. But, we also keep an open mind to going with the flow when not everything goes according to plan.

With that being said, here’s how we make it all work when it comes to travel.

Dining

- When we travel in the US, we rarely dine in full-service restaurants. The irony is we both worked in hospitality for decades. Anyway, in full-service restaurants, prices are usually higher for food and beverages, and in the US a standard tip is 15 – 20% of the total. In some larger cities restaurants now add on fees such as a service fee (not the servers tip) and a kitchen appreciation fee. Most people don’t pay attention to the fine print on the menu or the check.

- The European tipping culture is far better than in the US. Tipping is not required. Servers are paid an hourly salary at a level of other professions, which in turn makes dining in restaurants a bit more affordable.

Credit Cards, Points & Fees

- Our two major credit cards, are associated with 1. United Airlines and 2. Hilton Hotels. Ninety-five percent of all our purchases are made with our cards, which are paid off each month. The points programs with United and Hilton have earned us many free hotel rooms and flights, although of course flights always have fees attached.

- When in Europe we use our Chase Bank Visa card for transactions. Or, we use American Express, although AE is not widely accepted in Europe. Neither of these cards has a foreign transaction fee.

- We maintain a Charles Schwab Brokerage account (no monthly fees and no account minimum) and when we’re in Europe we use our CS debit card to withdraw cash from an ATM without having to pay a transaction fee.

- Note: some European ATM machines charge a fee, such as a conversion surcharge in addition to a transaction fee. We try to avoid those ATM machines, you can see the fees attached before you finalize your transaction.

Travel Insurance

- We purchase our travel insurance through Allianz. While the company offers policies for trip cancellations, lost luggage etc., we only purchase insurance for medical emergencies and repatriation. We purchase annually, ($276 total) rather than per trip as there is a savings in doing so. Note: rates are based on age.

Souvenir Shopping

- We stopped buying souvenirs years ago. We travel light and souvenirs take up valuable space in our bags, especially because we fly with carry on only.

Accommodations

- We book accommodations with Booking.com. We have, in the past, booked a few stays with Airbnb but we prefer the financial practices of Booking.com. We book all accommodations with no prepayment and free cancellation. In this way we’re not risking any deposit money, and if our plans change, it doesn’t cost us anything. Also, with Booking.com we earn discounts.

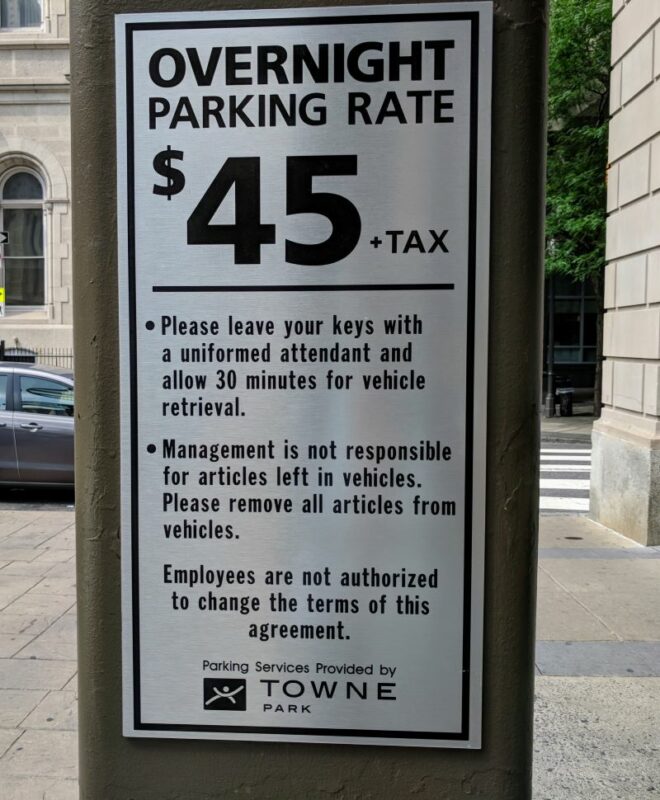

- If we do have to pay for a hotel stay, in the US, we book with Hilton whenever possible (to earn more points) and most often we’ll look for a property that is 10 to 15 miles outside of the city center. The rates are usually lower and most often there is free parking. Don’t get me started on valet parking rates!

- When we book hotel stays in Europe, we also book with Booking.com, usually just outside the city center.

Rental Cars – No, Thank You

- When traveling in Europe, we never drive. We don’t want to take on the expense of a rental car and insurance. Nor do we want to deal with finding parking and paying for said parking. We either walk to local locations, or take public transit. For longer distances we travel by train where we can sit back and relax.

An example of parking rates in New York City

Road Trip Hacks

If road trips, and exploring closer to home, are a better fit for you, here’s a link to our best learned road trip travel tips. Road trips are one of our favorite modes of travel. There’s nothing quite like a fabulous road trip where you can pull over wherever or whenever you’d like.

Our Best Learned Road Trip Travel Tips

Travel Hacks in Retirement

It doesn’t matter at what age you hope to and/or plan to retire. What matters most is purposeful planning. Achieving your optimal retirement and/or lifestyle choices comes with some level of planning and finding what best works for you. Leave a comment and let us know what are your favorite travel and/or life hacks.

Enjoyable post, as always.

We plan our itinerary and stays ahead of time and we pack our car with tons of stuff for our long road trips here in the states and Canada. Our longest was 12,000+ miles a few summers back and included Newfoundland and Florida! We also use Booking.com in conjunction with Choice Hotels and Wyndham (and sometimes Hilton) looking for the best deal in the US and Canada. You can’t get hotel points when you use Booking.com. We always use Booking.com for overseas along with airbnb.

We like renting cars overseas along with using trains, buses, etc. Having a car in Ireland and Scotland, driving the Amalfi coast and touring Italy – nothing like it.

Just thought I’d mention that the main reason we got a Charles Schwab free checking account (to use their debit card) years ago is that they also refund completely any and all ATM fees no matter where they are incurred. With the Schwab card you never even have to worry about fees and charges when it pops up on the ATM. You get a credit on your statement.

One other tip – when using your debit or credit card overseas and you are asked whether you want to pay in local currency or $ always pick the local currency. If you pick dollars they will charge you a conversion at a worse rate than your own bank does.

And the credit card companies give so many great deals that as long as you pay your card(s) off each month you can easily make over $1000 a year in free travel money by getting a new card every year or 2.

Thanks again for all the tips. Hope my few thoughts are helpful.

Steve

Enjoyable post guys,

We view travel very simmilar, but do prefer Airbnb over Booking.com, we like the long term discounts you can find (sometimes as much as 50%). Agree with the car rental, we only rent if absolutely necessary, and like you we feel tipping in the US has gotten out of controll, restaraunts should just pay a fair wage.

We still check bags, while not common, we have run into flights where he carrey on bags have been weighed (mainly in Asia), and with a 7kg limmit, there is no way we could stay under that if all we had was carrey on.

Thanks for sharing and I hope we run into each other some day in the future.

Thank you for the kind feedback, Lyle. Understandable about Airbnb, the long-term discounts can be a benefit for sure. I just have a “thing” about Airbnb. Ha! Ha! Interesting to learn about the carry on weight limits on some airlines. We haven’t yet run into that, fortunately, it’s mostly just size restrictions which haven’t been an issue for us. Like everything else, when the least expensive flights are booked, fees are attached for checked-in baggage. It’s all the random fees that can really add up quickly and make travel unnecessarily expensive. Continued safe travels and I’ll be following. Cheers ~

Ah… Steven, valid points that I forgot to mention in our post. 1. Charles Schwab refunds fees and 2. Choosing local currency for credit card charges. We do the same, thanks for the reminder! We haven’t looked in to getting new cards every couple of years, we’ll have to check that out. Thank you for sharing your great tips. I well-remember your 12,000 miles road trip. I chatted with Annie about Lunenburg. We loved Lunenburg so much we’ll be returning (and staying longer) this summer. I look forward to following your future adventures. Safe travels!

Great tips and photos. Your experience and approaches are so similar to ours! But wait, whaat? A kitchen appreciate fee? Do restaurants in the US pay their kitchen staff that poorly? I’ll just add that to the list of things we don’t miss about living there.

Thank you for the kind feedback. Actually, in some states restaurant employees now earn a living wage. Unfortunately, in far too many states restaurant employees still earn the bottom of the barrel wages. Depending on the restaurant, tips are sometimes shared between the servers and kitchen staff. Seemingly, the add-on fees are a way for the business owner to cover the costs of having to pay a living wage to the employees. Customers of the restaurant are paying for the increase in salaries, food, beverages, etc., which is understandable because the profit margins are so low, but in turn it has made dining expensive.